7 Common Budgeting Mistakes That Keep You Broke (And How to Fix Them!)

Introduction

Are you constantly struggling with money despite having a budget? You’re not alone! Many people unknowingly make budgeting mistakes that keep them stuck in a cycle of financial stress. The good news? These mistakes are 100% avoidable—and once you fix them, you’ll be on the fast track to getting out of debt and finally taking control of your money.

The fastest way to turn your financial situation around? Get the ultimate guide that teaches you exactly how to organize your budget and eliminate debt! Grab your copy here 👉 Click to Get Your Budgeting Blueprint Now!

Table of Contents

- Mistake #1: Not Tracking Expenses

- Mistake #2: Ignoring Emergency Funds

- Mistake #3: Setting Unrealistic Budgets

- Mistake #4: Relying on Credit Cards for Everyday Expenses

- Mistake #5: Forgetting to Adjust Your Budget

- Mistake #6: Overspending on Small Daily Purchases

- Mistake #7: Not Having a Clear Financial Goal

Mistake #1: Not Tracking Expenses

Why This Mistake is Costing You Money

If you don’t track your spending, you’ll never know where your money is going. Little expenses add up, leading to budget shortfalls and financial stress. Studies show that people who actively track their expenses save up to 30% more than those who don’t.

How to Fix It

Use a Budgeting App

Leverage technology to monitor your finances effortlessly. Here are some reputable budgeting apps:

- YNAB (You Need A Budget): Uses a zero-based budgeting system to ensure every dollar is accounted for, helping you plan ahead and make informed financial decisions.

- Mint: A free app that connects to your bank accounts, categorizes transactions, and provides insights into your spending habits. It also offers bill reminders and credit score monitoring.

- Goodbudget: Based on the envelope budgeting method, this app helps you allocate funds for different spending categories and manage your finances proactively.

Maintain a Spending Journal

If you prefer a manual approach, record every expense in a notebook or a digital document. Reviewing your spending patterns weekly can highlight areas where you can cut back.

Set Spending Limits

Establish clear budgets for different expense categories such as groceries, entertainment, and transportation. Regularly reviewing these limits ensures you stay on track and make adjustments as needed.

Example: Imagine you grab a $5 coffee every morning before work. That’s $25 a week, or $1,300 a year! Instead, if you make coffee at home, you could save over $1,000 annually—enough to kickstart an emergency fund or invest in your future.

💡 Want a simple, foolproof system to track your expenses and finally manage your money stress-free? Get the full step-by-step guide now!

Mistake #2: Ignoring Emergency Funds

Why This Mistake is Costing You Money

Without an emergency fund, unexpected expenses (medical bills, car repairs) can destroy your budget and lead to debt. The average unexpected expense costs $1,400, and without savings, many people turn to credit cards with high-interest rates.

How to Fix It

Start Small, Then Build Up

- Begin with $500-$1,000 as a starter emergency fund.

- Gradually increase it to cover 3-6 months of essential living expenses.

Open a Dedicated Emergency Savings Account

- Use a high-yield savings account to keep your funds accessible yet separate from daily spending.

- Automate monthly deposits to build your emergency fund effortlessly.

Example: Sarah was doing well financially, but when her car unexpectedly broke down, she had no savings and had to rely on a high-interest credit card. If she had an emergency fund, she could have covered the repair without going into debt.

🚀 Struggling to build an emergency fund? The budgeting blueprint shows you EXACTLY how! Start saving today!

Mistake #3: Setting Unrealistic Budgets

Why This Mistake is Costing You Money

Many people set unrealistic budgets that are either too strict or too vague. A budget that’s too restrictive can lead to frustration and burnout, while a budget without clear structure can result in overspending.

How to Fix It

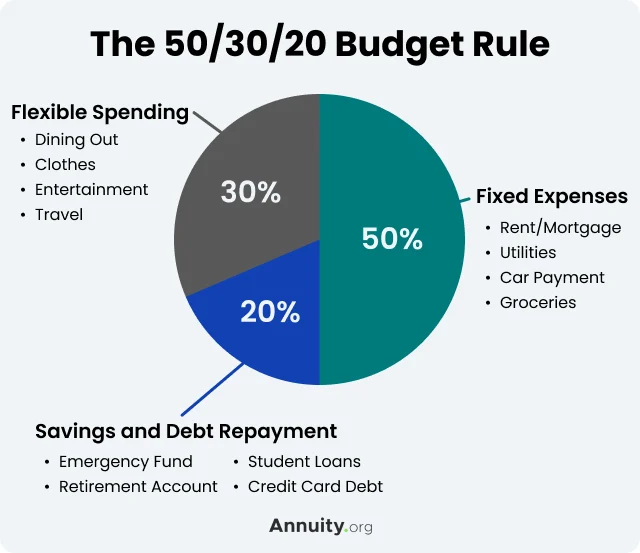

Use the 50/30/20 Rule

A well-balanced budget should account for:

- 50% of income for necessities (rent, food, bills).

- 30% for discretionary spending (entertainment, dining out, hobbies).

- 20% for savings and debt repayment.

Be Flexible & Adjust as Needed

Your budget should evolve with your financial situation. Reassess it monthly to make sure it reflects any changes in income, expenses, or goals.

Example: Emma created an overly strict budget, cutting all entertainment spending. After a month, she felt frustrated and started overspending. Instead, she adjusted her budget to allow for a reasonable entertainment fund, which made it easier to stick to long term.

Mistake #4: Relying on Credit Cards for Everyday Expenses

Why This Mistake is Costing You Money

Using credit cards for daily purchases can lead to high-interest debt, especially if you only pay the minimum balance each month. The average American household carries over $6,000 in credit card debt, with interest piling up rapidly.

How to Fix It

Switch to a Debit or Cash System

- Use cash for small, everyday expenses to stay within budget.

- Utilize a debit card for essentials instead of relying on credit.

Pay Off Balances in Full

Avoid interest charges by paying off your credit card in full each month. Set up automatic payments to stay on track.

Example: Mike used his credit card for groceries and gas but didn’t pay off his full balance each month. Over a year, he accumulated $800 in interest fees. Switching to a debit card for essentials helped him stay debt-free.

Mistake #5: Forgetting to Adjust Your Budget

Why This Mistake is Costing You Money

Life circumstances change—raises, unexpected expenses, and new financial goals should all prompt budget adjustments. Sticking to an outdated budget can cause unnecessary financial strain.

How to Fix It

Review Your Budget Regularly

- Set a monthly budget check-in to evaluate spending and make necessary adjustments.

- Reallocate funds based on changing priorities, such as higher savings contributions after a raise.

Account for Seasonal Expenses

Certain months bring extra expenses, like holiday shopping, vacations, or back-to-school costs. Planning ahead prevents financial surprises.

Example: Sarah got a 10% raise but didn’t adjust her budget. Instead of saving more, she unknowingly spent the extra income. After revising her budget, she allocated the raise toward her emergency fund and investment account.

Mistake #6: Overspending on Small Daily Purchases

Why This Mistake is Costing You Money

Many people underestimate the impact of small daily expenses. While a few dollars here and there may seem insignificant, they can add up to thousands of dollars per year, leaving you with less money for savings, investments, or debt repayment.

How to Fix It

Identify Unnecessary Daily Expenses

- Track all small purchases for one month to see where your money is going.

- Look for spending patterns (e.g., daily coffee, frequent snacks, unnecessary subscriptions).

Set a “Fun Money” Budget

Instead of cutting everything, allocate a small, fixed amount for discretionary spending. This prevents impulse purchases while allowing some flexibility.

Example: John used to buy a $10 lunch every workday, spending $200 per month. He started meal prepping at home, cutting his lunch budget to $50 per month—saving $1,800 per year without sacrificing his favorite meals.

💡 Want a better system to control small expenses while still enjoying life? Check out this budgeting guide!

Mistake #7: Not Having a Clear Financial Goal

Why This Mistake is Costing You Money

Without clear financial goals, you’re more likely to spend aimlessly rather than build wealth. A lack of direction leads to poor financial decisions and delayed financial independence.

How to Fix It

Set SMART Financial Goals

Your goals should be:

- Specific – Define exactly what you want (e.g., “Save $10,000 for a house down payment in 12 months”).

- Measurable – Track progress over time.

- Achievable – Set realistic expectations based on income.

- Relevant – Align your goals with your overall financial plan.

- Time-bound – Have a clear deadline.

Automate Your Savings

Once you set your goal, make it effortless by setting up automatic transfers to a dedicated savings account.

Example: Emily wanted to build an emergency fund of $5,000 but never got around to saving. She set up an automatic transfer of $200 per month, and within two years, she hit her goal without even thinking about it.

💡 Want a foolproof plan to set and achieve your financial goals? This budgeting guide can help!

Conclusion

Budgeting isn’t about depriving yourself—it’s about giving yourself more freedom over your money. By avoiding these common mistakes, you set yourself up for financial security, peace of mind, and the ability to enjoy life without constant financial stress.

Here’s what to take away from this guide:

- Tracking your spending helps you identify where your money goes, so you can cut waste and spend smarter.

- Setting realistic budgets makes it easier to stick with long-term, reducing financial frustration.

- Emergency funds prevent financial disasters, saving you from falling into debt during unexpected events.

- Credit cards should work for you, not against you—using them wisely avoids costly interest payments.

- Your budget should evolve with your life—flexibility is key to staying on track.

- Every small expense adds up—but with intentional spending, you can redirect money toward your goals.

- Clear financial goals help you build wealth faster—the more specific, the better.

Taking control of your budget doesn’t have to be overwhelming. With the right tools and strategies, you can start making smarter money moves today. If you want a step-by-step plan to master your finances, check out this comprehensive budgeting guide. It provides actionable steps to help you fix budgeting mistakes, eliminate debt, and finally feel confident about your financial future.

Your financial journey starts now. Take that first step toward stress-free finances today!

Leave a Reply